Receivable(s) management is the process of making decisions relating to investment in trade debtors. If you want to increase sales turnover and profits of the firm, you. have to sell goods on a credit basis, which includes the risk of bad debts.

Best Practices for Accounts Receivable Management

Follow these tips to ensure efficient and effective accounts receivable management.

1. Use of Electronic Billing & Payment

Ditch paper and snail-mail billing, and paper checks. Those are easy to lose and time-consuming to track. Instead, switch to an electronic invoicing system that lets clients make payments easily online.

Integrate your billing and payments this way automates your record-keeping, so there’s less for you to keep track of and less room for human error.

Use invoicing software with integrated payment processing, so clients can click right from their bill to initiate payment, and the system can automatically record payment for you. This also lets you set up options for customized, systematic follow-up when payments are late. Your business can stay on top of collecting payments, while keeping communications tailored to each customer, without any wasted time.

2. Outline Clear Billing Procedures

Approach your billing process with clarity and consistency. Document the process, so everyone in your company follows the same procedures.

Your billing process should include:

- Billing periods and invoicing dates.

- What information to include on each invoice (e.g. Purchase Order numbers, addresses, etc.).

- Recordkeeping procedures.

- Periodic AR assessment and follow-up.

- Collections procedures for overdue payments.

In addition to daily, weekly and monthly steps you need to follow to bill clients accurately, include in your documentation:

- Billing contact information for each client.

- Unique billing details or steps for each client, if applicable.

- Payment details and notes for each client.

3. Set Credit & Collection Policies — and Stick to Them

You may or may not be interested in making credit available to some clients. If you do, set clear credit policies ahead of time to avoid extending too much credit to some clients and make it easy for anyone in your business to determine whether to extend credit when a client requests it.

Similarly, clear collection policies ensure you can take a proactive approach to addressing overdue accounts and streamline your process. Your collection policy should include periodic reviews of accounts receivable and steps to take to follow up with clients and collect overdue balances.

4. Be Proactive

With clear procedures in place, you can be proactive about collecting payments. Create a process where you’re prompted to contact a client on the first day a payment is late, so they’re aware of the overdue balance immediately and have clear steps to pay.

Electronic billing and payment systems can help centralize and resolve invoicing and payment matters with your clients.. For example, you can set invoicing software to follow up with clients the first day payment is late, then once each week until the account is settled.

5. Set up Automations

Save yourself time and add consistency to your process by automating account communications with your clients.

An account receivable management software should take care of this for you — you can set up a form email to send along with an invoice, a thank-you email to send upon payment, and reminders to send when payment is overdue.

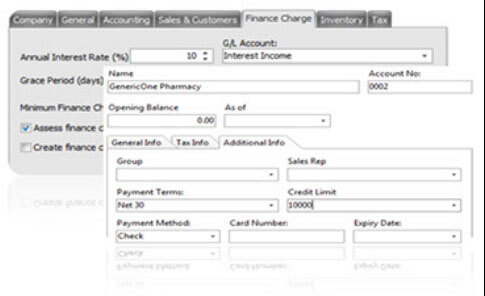

If you use paper billing, you can still automate your communications to save time and streamline your process a little. Use integration software like ActiveOne Business Management Solution to set up triggers to contact clients based on inputs into your records. For example, set up a form email to send to a client when you enter into a spreadsheet that you’ve received a payment. Or create an item in your to-do list to print and mail a receipt.

6. Make It Easy for Customers

Most payment issues you’ll encounter are because clients have trouble receiving, viewing or understanding your invoices, or because they don’t have access to a quick and convenient payment method.

Eliminate those issues by setting up a system that’s easy for customers to use. Use an electronic invoicing system that delivers invoice information and links directly within an email to avoid triggering spam filters with an attachment. Set up easy electronic payment portals that let clients pay online as soon as they read your invoice.

7. Use the Right KPIs

To make sure your accounts receivable processes are functioning properly, keep track of these AR performance metrics:

- Days Sales Outstanding (DSO): This is the top metric you want to optimize your processes to reduce. DSO is the average amount of time it takes to collect payment. Aim to keep your DSO below 30 days.

- Average Days Delinquent (ADD): This is how many days on average client payments are overdue. This is another number you want to keep as low as possible. If it rises, check your processes to ensure billing is going smoothly and AR is adequately staffed to accommodate collections.

- Turnover ratio: This number shows you how quickly you’re collecting revenue from clients (i.e. turning accounts into cash), and indicates your cash flow. Keep this number low. A high ratio means you have a lot of open accounts with uncollected revenue — which should prompt you to revisit your billing and collections processes.

- Collection Effectiveness Index (CEI): This is the percentage of accounts you turn over, or collect revenue on. You want this to be as close to 100 as possible, indicating you’re collecting payment from all of your clients.

- Revised invoices: You want to avoid the need to revise invoices if you can. If you see a rise in your number of revised invoices over time, or during a certain period, look at your billing policies and possibly consider staffing needs to ensure efficiency and avoid errors that delay payment.

8. Involve All Teams in the Process

Don’t limit your accounts receivable process to your accounts receivable team. Making all client-facing teams, including, for example, the sales team, privy to the process helps keep everyone on the same page. It increases efficiency, avoids redundancies, and eliminates mistakes that could waste time or cost your business.

Conclusion:

The main purpose of accounts receivable management in your business is to maximize your cash flow while minimizing costs and maintaining good client relationships.

Moving to electronic billing and payments is a vital step to streamline and organize this process to reduce errors and make the process easy on your clients.

Putting proper systems in place — and sticking to them — will significantly improve how you experience accounts receivable. Much of this process can be systematized and automated, freeing you to focus on the bigger picture of the business.

Read more of our blogs for further information.

Source(s) 1: https://upflow.io/

“No copyright infringement is intended”